Gold Card Visa Things To Know Before You Buy

Table of ContentsFascination About Gold Card VisaThe Ultimate Guide To Gold Card Visa4 Easy Facts About Gold Card Visa DescribedEverything about Gold Card VisaThe Buzz on Gold Card VisaThe Ultimate Guide To Gold Card VisaGetting The Gold Card copyright Work

Such a guideline would certainly also be a separation from the current U.S. government tax obligation regulations which enforces a globally revenue tax on united state residents and locals. Thus, the program might bring in foreign individuals that could or else stay clear of the USA because of its hostile tax obligation reach. This new activity accompanied another major adjustment in migration policy.The pronouncement targets petitioners using the H1-B program for specialty profession workers. Effective since September 21, 2025, new petitioners will certainly be rejected access into the United States "unless their request is come with by a $100,000 payment," according to the White Home's fact sheet on the pronouncement. The proclamation adds that the limitation will certainly expire in 12 months if the Head of state determines not to extend it.

At the same time, the new H-1B constraints highlight the Administration's willingness to improve traditional employment-based immigration classifications via financial barriers. Stakeholders need to carefully keep an eye on forthcoming firm assistance, examine tax obligation ramifications, and get ready for both the chances and difficulties these plans present as extra details ends up being available. Aggressive planning will certainly be vital as the landscape of united state

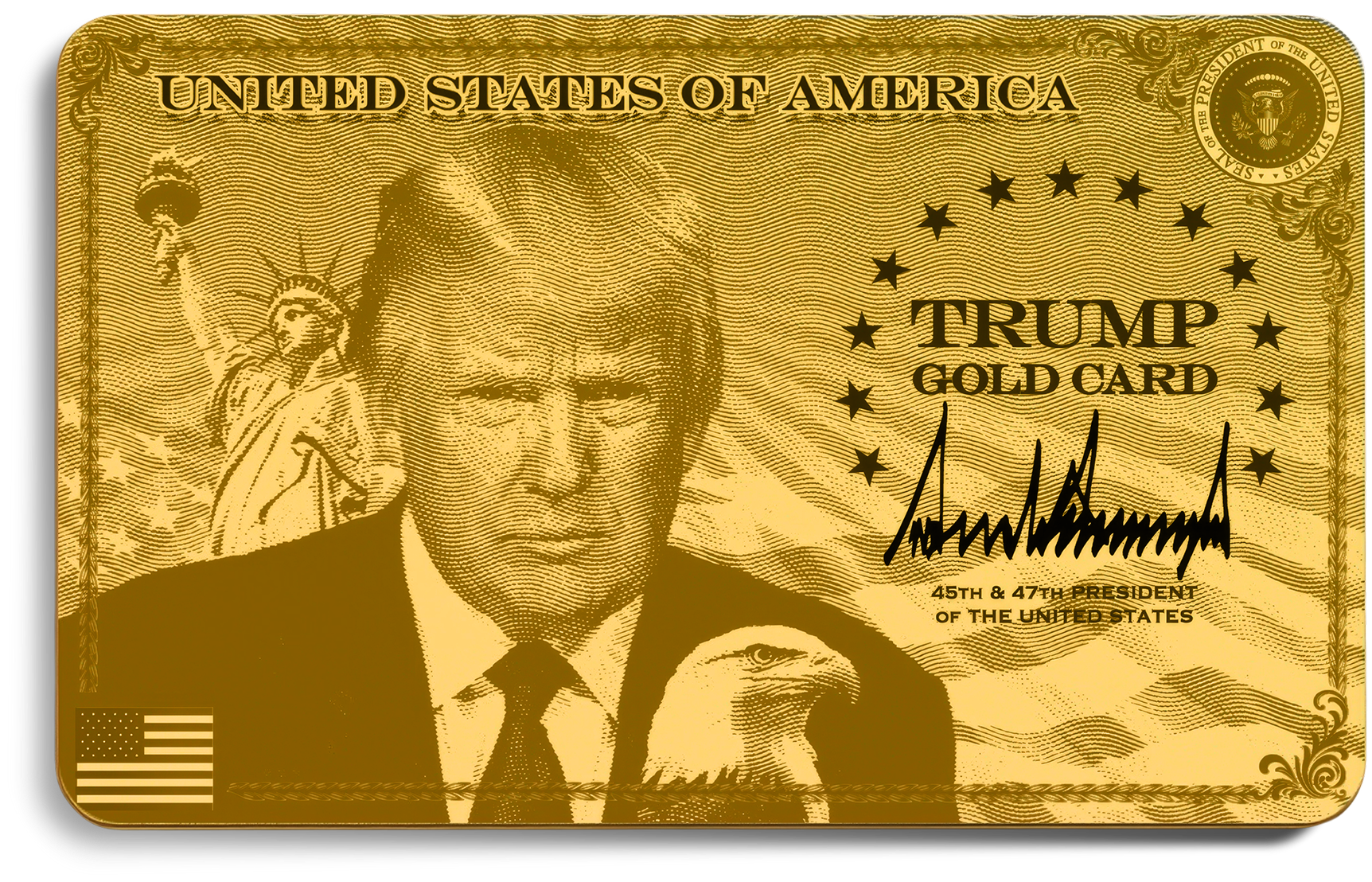

The "Gold Card": Examining the current Immigration Advancement In public remarks on Tuesday February 26th, President Trump discussed a proposal for a brand-new kind of U.S. visa, a "Gold Card". While the President did not explain, he recommended that this new visa can be provided to firms or to people for $5 million per card.

The Greatest Guide To Gold Card Visa

The U.S. program differs as it is made to settle the U.S. financial debt instead of create jobs through financial investment. If this program ends up being legislation, it will be the most costly Golden Visa worldwide. There is a substantial tax obligation advantage attached to this Gold Card proposal. Wealthy foreign nationals tend to avoid becoming U.S.

people to prevent united state taxation on their globally income. To bring in future Gold Card owners, the administration states the united state will certainly not tax them on their worldwide revenue, yet only on their U.S. earnings. This will give Gold Card holders a benefit not offered to existing long-term locals or U.S

It is unclear if the concept is for this advantage to continue if they select to become U.S. citizens or is only offered to those who stay in Gold Card standing. We will certainly update this blog as more details emerge regarding this program.

The Ultimate Guide To Gold Card Visa

For the US Gold Card to end up being a law, the proposal needs to pass your home of Reps and the Us senate to safeguard bipartisan support, which can be tough given its questionable nature. Furthermore, companies like the US Citizenship and Immigration Provider (USCIS) and the US Department of Homeland Safety (DHS) will certainly require to attend to concerns pertaining to nationwide safety, identification checks, cash laundering, and the honest implications of the Gold Card visa holder.

United States Embassy and Consulates had actually issued much more than one million non-immigrant visas, a practically 26 percent rise from 2023. This growth in worldwide engagement can create a promising setting for the US Gold Card visa in the future.

Notably, as we will certainly discuss later, it legal modifications to implement a Gold Card visa have been left off one of the most current budget propositions. Under this "strategy", the Gold Card program would approve permanent residency for a minimal $5 million investment. Nevertheless, succeeding statements from the administration have suggested that the EB-5 and Gold Card programs might coexist in some capability, potentially under the oversight of the Department of Business.

6 Simple Techniques For Gold Card Visa

Nevertheless, the President can not single-handedly remove the EB-5 programthis needs an act of Congress. The EB-5 program was originally developed in 1990 and later strengthened by the RIA in 2022. Since it is ordered in the Immigration and Citizenship Act (INA), any type of effort to repeal or modify the program would require the flow of new regulations via both chambers of Congress.

This is because of the fact that, unlike various other immigration costs that were not enabled to go through the budget costs process as modifications, the intent behind the Gold Card is to straight minimize the deficit. Gold Card Visa. However, since this post, no mention of the Gold Card or similar programs can be found in your home or Senate proposals for the current budget plan.

Provided the complexity of this procedure, any modifications to the EB-5 program would likely take months or perhaps years to materialize. Historically, immigration-related legal modifications have actually dealt with considerable difficulties, calling for bipartisan support, economic justification, and lawful examination. Previous attempts to present substantial overhauls to the EB-5 programsuch as boosting financial investment limits or tightening local facility regulationshave taken years to pass.

Under the EB-5 Reform and Honesty Act (RIA), the EB-5 Regional Facility (RC) program is accredited via September 30, 2027. This suggests that unless Congress repeals, changes, or changes the program, it will certainly remain essentially until that day. Further, Congress has actually specifically indicated investment amounts for EB-5 and that can not be changed by exec order or regulation.

The Basic Principles Of Gold Card Visa

If the Gold Card visa requires a $5 million financial investment but does not supply the same flexibility in work production requirements, it might negatively impact investment flow right into particular markets, potentially restricting possibilities for middle-market capitalists. One of the greatest debates in support of retaining the EB-5 visa is its tried and tested track document in promoting the U.S.

By setting the minimum investment threshold at $5 million, the united state government might be: Targeting ultra-high-net-worth investors Going for bigger facilities financial investments Developing a streamlined pathway for international company leaders Nonetheless, boosting the financial investment amount can additionally evaluate numerous prospective capitalists, especially those from arising markets that might battle to satisfy such a high financial limit

Examine This Report on Gold Card Visa

His lawsuits initiatives contributed in Shergill, et al. v. Mayorkas, a landmark case that led to the U.S - Gold Card Visa. government acknowledging that under the INA, L-2 and E visa spouses are accredited to function case to their standing, removing the need for separate EAD applications. This case has actually changed job permission for countless families throughout the USA

By the authority vested in me as Head of state by the Constitution and the laws of the United States of America, it is hereby ordered: Section 1. My Administration has actually functioned relentlessly to undo the dreadful migration plans of the prior management.

Sec. 2. The Gold Card. (a) The Assistant of Business, in sychronisation with the Assistant of State and the Assistant of Homeland Safety, shall establish website a "Gold Card" program authorizing an alien that makes an unlimited gift to the Division of Business under 15 U.S.C. 1522 (or for whom a company or comparable entity makes such a gift) to establish eligibility for an immigrant visa making use of an expedited process, to the degree consistent with regulation and public safety and security and nationwide protection problems.

(b) In adjudicating visa applications, the Secretary of State and the Assistant of Homeland Security shall, constant with applicable law, deal with the gift specified in subsection (a) of this area as evidence of qualification under 8 U.S.C. 1153(b)( 1 )(A), of extraordinary service capacity and nationwide benefit under 8 U.S.C. 1153(b)( 2 )(A), and of qualification for a national-interest waiver under 8 U.S.C.

The 7-Minute Rule for Gold Card Visa

(c) The Secretary of Business shall deposit the gifts contributed under subsection (a) of this area in a different fund in the Division of the Treasury and utilize them to promote business and American market, consistent with the statutory authorities of the Department of Business, see, e.g., 15 U.S.C. 1512.